Explain how operations would have differed in Year 2 and Year 3 if the company had been using Lean Production with the result that ending inventory was zero. Remember cost of goods sold is the cost to the seller of the goods sold to customers.

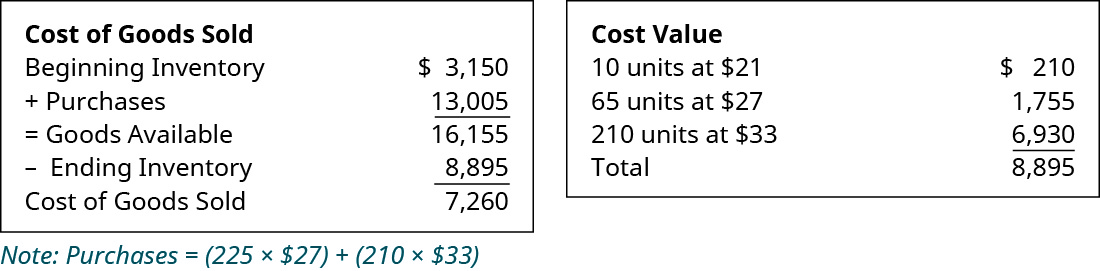

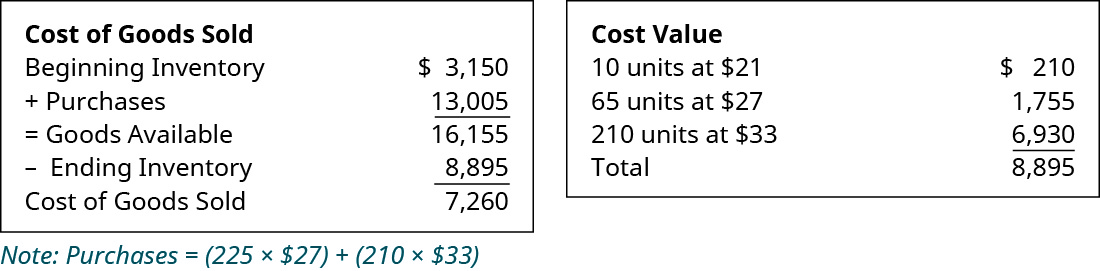

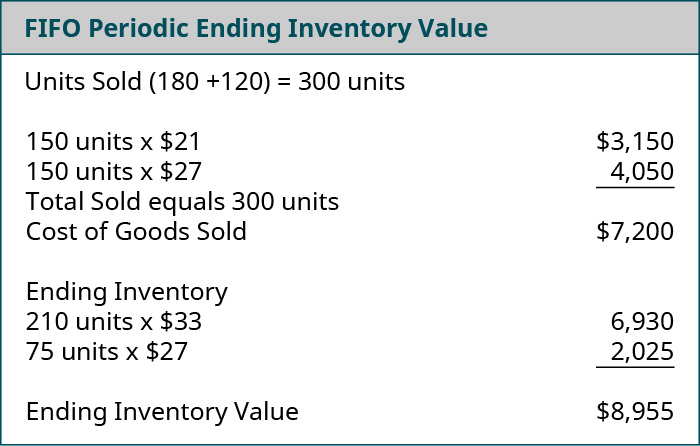

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Impact of an Inventory Overstatement on Income Taxes.

. For a merchandising company the cost of goods sold can be relatively large. PROBLEM 713 Absorption and Variable Costing. When an ending inventory overstatement occurs the cost of goods sold is stated too low which means that net income before taxes is overstated by the amount of the inventory overstatement.

Prepare a contribution format income statement for May. This difference of net operating income is because of fixed manufacturing overhead that becomes the part of ending inventory under absorption costing but not under variable costing system. Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income.

Even though we do not see the word Expense this in fact is an expense item found on the Income Statement as a reduction to Revenue. Assume that the company uses variable costinga. Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income.

Assume that the company uses variable costing. Cost of goods sold and Inventory. Scrap items excess unusable material that gets sold off Supplier fraud.

The loss was primarily due to a2 million loss on the write-down of inventory near year-end. Determine the unit product cost. Prepare a contribution format income statement for May.

Determine the unit product cost. The ending inventory absorbs a portion of fixed manufacturing overhead and reduces the cost burden of the current period. Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income.

Inventory reconciliation is not as simple as adjusting the book balance to match the physical count. Assume that the company uses variable costinga. Determine the unit product costb.

Determine the unit product costb. Prepare a contribution format income statement for May3. 3 marks 1 ACVC Revision set Question 2 Final sem 1 1415 Encik Nordin president of StrongString Company is surprised at the performance of his company.

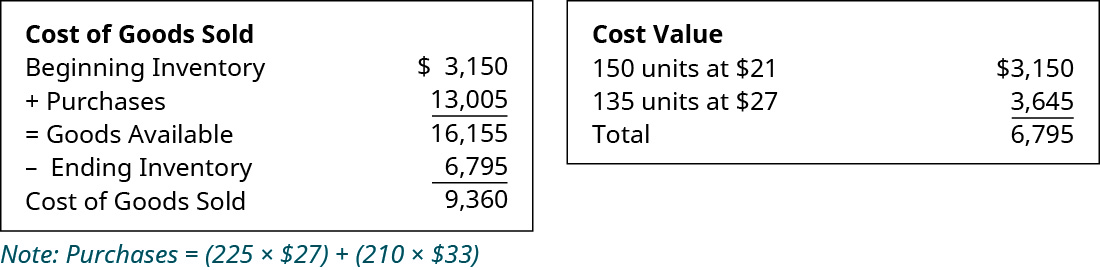

Equals Cost of Goods Sold divided by average inventory - measures the number of times inventory turns over during the period. The differences for the four methods occur because the company paid different prices for goods purchased. The ending inventory balance on 123112 is 4 units at a cost of USD 5.

If we wait and report the loss next year net income for. 6 marks c Explain the reason for any difference in the ending inventory balance under the two costing methods and the impact of this difference on reported net operating income. Since a companys purchase prices are seldom constant inventory costing method affects cost of goods sold inventory cost gross margin and net income.

Assume that the company uses variable costing. However income taxes must then be paid on the amount of the overstatement. Any discrepancy between a companys actual ending inventory versus whats listed in its automated system may be due to shrinkagea loss of inventory for any number of reasons including theft.

Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income. This difference is because of fixed manufacturing overhead that becomes the part of ending inventory under absorption costing system. Prepare a contribution format income statement for May3.

Differences between Inventory Costing Methods. During this process youll discover whether any discrepancies exist. Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income.

All expenditures needed to acquire goods and to make them ready for sale are included as the inventorial cost. Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income. Prepare a contribution format income statement for the month3.

The cost of ending inventory and the cost of goods sold is determined using various methods of them the commonly used methods are. In particular you should consider following any or all of the steps noted below. Seeing a difference between your physical inventory count and your inventory management count could be due to a variety of issues such as.

Prepare a contribution format income statement for May. First-in first-out FIFO Last in first-out LIFO and. The ending inventory absorbs a portion of fixed manufacturing overhead and reduces the burden of the current period.

The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the LIFO reserve. With Lean Production production would have been geared to sales in each year so that little or no inventory of finished goods would have been built up in either Year 2 or Year 3. No differences would occur if purchase prices were constant.

Cost of Goods Sold is an EXPENSE item. There may be other reasons why there is a difference between the two numbers that cannot be corrected with such an adjustment. Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income.

Assume that the company uses variable costing. Production Constant Sales Fluctuate LO1 LO2 LO3 LO4 Tami Tyler opened Tamis Creations Inc a small manufacturing company at the beginning of the year. -- a higher ratio means faster turnover-- more efficient purchasing and production techniques as well as high product demand will boost this ratio.

The CFO Joe Mammoth suggests the company wait to record the write-down of inventory until early 2019. Detennine the unit product costb. Determine the unit product cost.

Explain the reason for any difference in the ending inventory balances under the two costing method and the impact of this difference on reported income.

Ending Inventory Formula Step By Step Calculation Examples

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

Calculate The Cost Of Goods Sold And Ending Inventory Using The Periodic Method Principles Of Accounting Volume 1 Financial Accounting

0 Comments